In the fourth and final Federal Budget of the Government’s current term, Treasurer Jim Chalmers has handed a budget that may decide whether Labor will hold onto a second term in Government.

The focus in this Budget seeks to continue addressing the cost of living and housing crisis, while driving growth and productivity, to deliver a message of responsible economic management of the current Government ahead of the upcoming 2025 Federal Election.

With the budget now forecasted for years of deficits, the Government has declared it would restrain spending and deliver $2.1 billion in savings and reprioritisations, including lowering spending on consultants.

The money in this Budget will be targeted towards taxpayers through a modest tax cut at the lowest tax rate, providing significant increase in Medicare rebates to bulk billing practices, and providing cost of living relief to students, households and first home owners.

There were no new tax measures announced to support to small businesses in this year’s Budget such as an extension to the instant asset write off, and there were no new measures in the reform of superannuation.

The tax team at Prosperity bring you the main highlights from the Budget for businesses and individuals.

Personal Income Tax — Cost of Living Tax Cuts

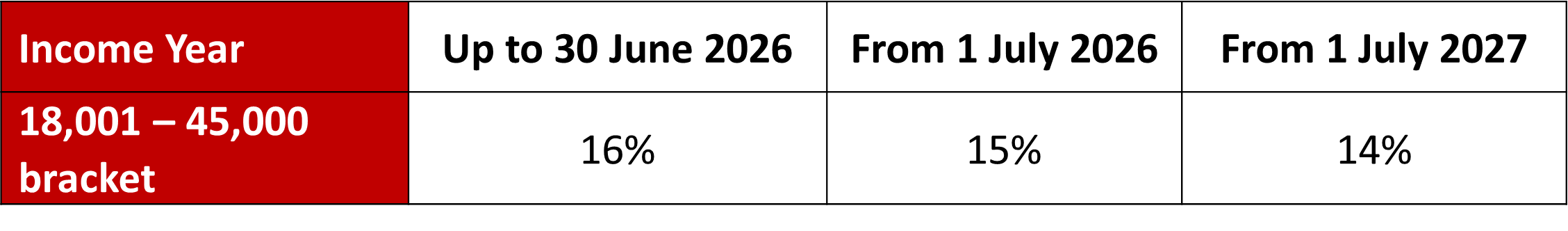

The Government announced tax cuts for every Australian taxpayer by reducing of the lowest tax rate, currently 16% for income between $18,201 and $45,000, down to 15% from 1 July 2026. This is proposed to further reduce to 14% from 1 July 2027.

A worker on average earnings of $79,000 will get a new tax cut of $268 in 2026/27 and $536 per year from 2027/28, compared to 2024/25 tax settings. Excluding tax offsets and other taxes, this new tax cut is expected to apply equally to all taxpayers earning over $45,000 annually.

Personal Income Tax — increasing the Medicare levy low-income thresholds

The Government has announced further increase to the Medicare levy-low-income thresholds for singles, families, and seniors and pensioners by 4.7 per cent from 1 July 2024.

The threshold for singles will be increased from $26,000 to $27,222. The family threshold will be increased from $43,846 to $45,907.

Individuals and Small Businesses - Energy Cost Relief

A six month extension to last year’s energy cost relief policy by implementing a further one off $150 in power bill rebate for households and around one million small businesses through to 31 December 2025. The payment will be via two quarterly payments of $75 starting 1 July 2025.

Student Debts

The Government announced it will pass legislation to reduce all outstanding Higher Education Loan Program (HELP) and other student debts by 20 per cent. The 20 per cent reduction is in addition to the recent reform of indexation that took effect from 1 June 2024.

The Government will also increase the minimum HELP repayment threshold from $54,435 in 2024–25 to $67,000 in 2025–26.

Medical and Health Sectors

The Government is allocating $8.5 billion in the Budget to invest in Medicare.

- Bulk billing incentives – The Government announced it will expand the bulk billing incentives by making last year’s announced tripling of bulk billing incentives measure to apply to all Australians from 1 November 2025.

- In addition, it is announced that a new Bulk Billing Practice Incentive Program will support practices that bulk bills 100% of their patients with an additional 12.5% loading payment on their Medicare rebates. This means a standard consult currently paying $42.85 in Medicare rebate will, with the expanded bulk billing incentive and loading payment, increase up to $69.56 for metropolitan practices, and up to a maximum of $86.91 in remote locations.

- Healthcare – The Government also announced a further $617 million investment into the healthcare industry by providing 400 nursing scholarships and funding the training of 2000 new GP trainee a year, by 2028.

Hospitality Sector and Alcohol Producers

Some support for this sector with the Government pausing indexation on draught beer excise and excise equivalent customs duty rates for a two‑year period, from August 2025.

Under this measure biannual indexation of draught beer excise and excise equivalent customs duty rates due to occur in August 2025, February 2026, August 2026, and February 2027 will not occur. Biannual indexation will then recommence from August 2027.

First Home Buyers

The Government announced an expansion to first homebuyers support by increasing access to Labor’s Help To Buy program, under which the Commonwealth will provide an equity contribution of up to 30 per cent for an existing home and 40 per cent for a new home.

The scheme will further increase income caps from $90,000 to $100,000 for individuals and from $120,000 to $160,000 for joint applicants and single parents, while property price caps are also to be lifted in line with the average house prices in each state and territory.

Prior to the Budget, the Government introduced legislation to ban foreign citizens from buying existing homes for two years from 1 April 2025, unless an exception applies. This law is now in effect.

Strengthening Tax Compliance

The following tax compliance measures were announced in the Budget with further funds being provided to the ATO over the next four years starting 1 July 2025 for the following:

- $717.8 million for a two-year expansion and a one-year extension of the Tax Avoidance Taskforce. This supports the ATO’s continued tax compliance scrutiny on multinationals and other large taxpayers.

- $155.5 million to extend and expand the Shadow Economy Compliance Program to reduce shadow economy behaviour such as worker exploitation, under‑reporting of taxable income, illicit tobacco and other shadow economy activity that enables non‑compliant businesses to undercut competition.

- $75.7 million to extend and expand the Personal Income Tax Compliance Program. This will enable the ATO to continue to deliver a combination of proactive, preventative and corrective activities in key areas of non-compliance.

- $50.0 million over three years from 1 July 2026 to extend the Tax Integrity Program. This will enable the ATO to continue its engagement program to ensure timely payment of tax and superannuation liabilities by medium and large businesses and wealthy groups.

Superannuation – Payment of Super Guarantee on Paid Parental Leave

In last year’s Federal Budget, it was announced superannuation will be paid on Commonwealth Government-funded Paid Parental Leave (PPL) starting from 1 July 2025. This measure is now law and superannuation will be paid at the rate of 12%, in line with the superannuation guarantee rate from 1 July 2025. The scheme will be administered by the ATO and will be paid as a lump sum, including an interest component, following the end of each financial year. Eligible parents can expect the first payment to be made from July 2026.

Superannuation – Prior Year Policies

There were no other significant announcements to Superannuation in the Budget.

A number of policies announced in the prior years’ Federal Budget have not been legislated at the date of this publication. Should these not be legislated before the Federal Election is called, it will be up to the party that holds Government to decide whether these policies are to be re-introduced.

- From a start date of 1 July 2025, the Government will introduce an additional 15% tax on superannuation earnings where the member balance exceeds $3 million. At the date of this publication, legislation regarding these measures is before Parliament and has not passed.

- The other major change to commence 1 July 2026 will require employers having to pay their employees superannuation guarantee amount at the same time as they make their salary payments, instead of the current quarterly cycle. At the date of this publication, the proposed legislation is not yet introduced into Parliament.

Superannuation – Other

Although not a new announcement, we remind readers that the superannuation guarantee rate is set to have its final legislated increase from the current 11.5% to 12% from 1 July 2025, where it will remain.

To view our Tax & Superannuation Federal Budget Report, click here.

We are available to discuss your specific circumstances with you and to assist with any decisions you might be considering. Don’t hesitate to get in touch with your Prosperity Adviser today or give us a call on 1800 855 844.