Land tax in NSW is an annual tax which is levied as at 31 December on property owned by a taxpayer that exceeds the NSW land tax thresholds.

In 2017, NSW introduced surcharge land tax which imposes a higher rate of land tax on residential land owned by non-citizens. Other states in Australia have similar regimes.

In recent years, Revenue NSW has increased audits related to surcharge land tax on residential properties owned by non-Australian citizens.

This publication outlines how non-citizens of Australia can review their NSW surcharge land tax liabilities on residential properties owned in NSW. In appropriate circumstances, they may also seek written confirmation from Revenue NSW that the property is used and occupied as their principal place of residence.

What is surcharge land tax in NSW?

Surcharge land tax in NSW is payable on residential land owned by a foreign person, as defined under section 5A of the Land Tax Act 1956 (NSW) (LTA 1956).

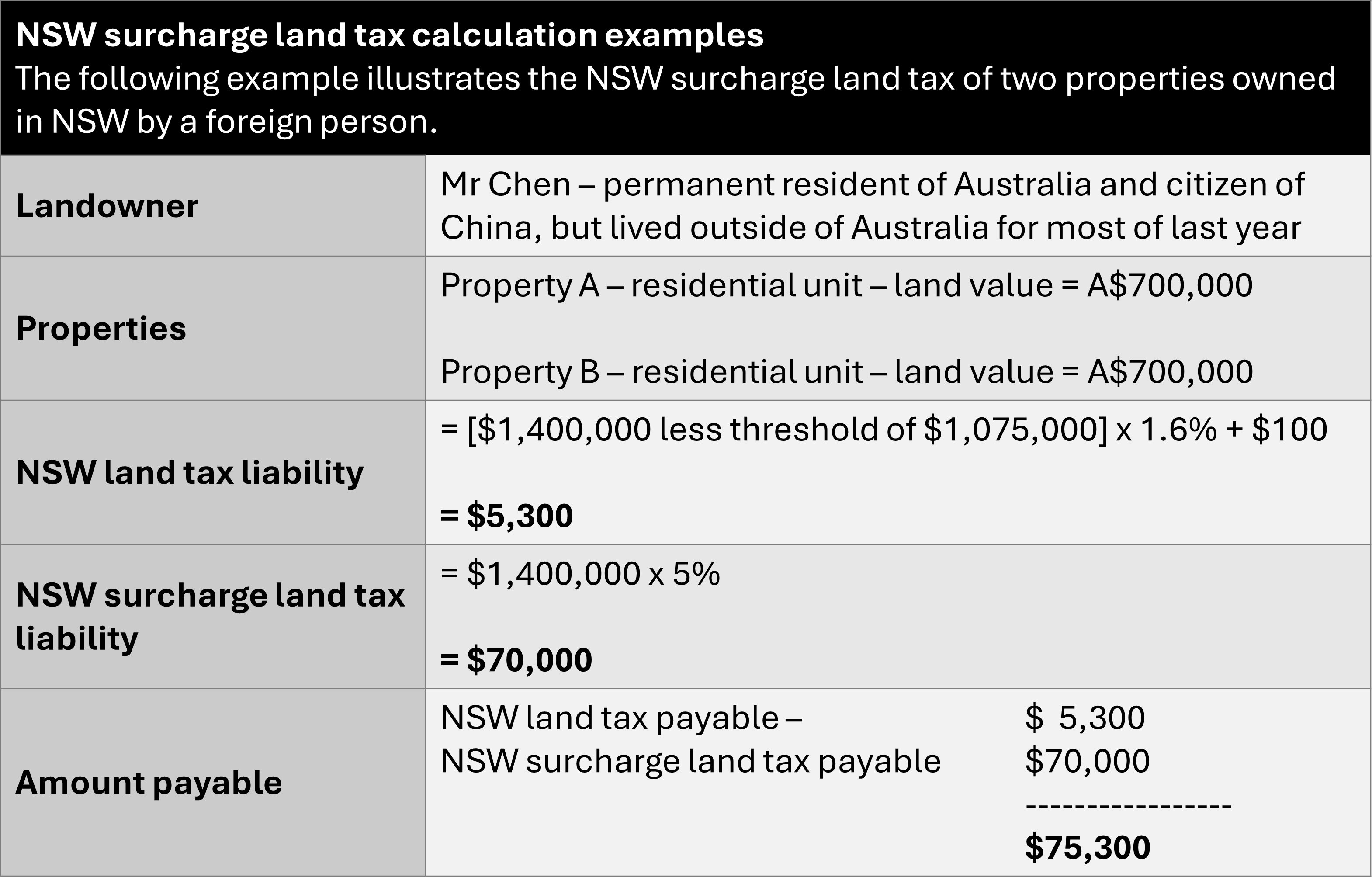

The NSW surcharge land tax rate is 5% of the unimproved land value, effective from the 2025 land tax year onwards.

Foreign Persons

A foreign person is an individual that is not either:

- An Australian citizen, or

- A Permanent resident of Australia and where the taxpayer has lived in Australia for more than 200 days in the 12 month period prior to the taxing date of 31 December

(refer section 2A of LTA 1956 and section 104J of the Duties Act 1997, NSW)

Principal place of residence exemptions

Exemptions from NSW surcharge land tax exists for a person’s principal place of residence (section 5B of LTA 1956).

The exemption applies to a person for a NSW land tax year only if:

- The person is a permanent resident at midnight on 31 December on the previous year; and

- The Chief Commissioner of State Revenue is satisfied that during the land tax year, the person intends to use and occupy the land as the principal place of residence;

- the person lodges a declaration with the Chief Commissioner.

For the 2023 land tax year onwards, the persons will need to be physically within Australia for a continuous period of 200 days during the land tax year. However, the Chief Commissioner may waive this requirement in exceptional circumstances (refer section 5B(2A)-(2B) of the LTA 1956).

The Revenue NSW website requires permanent residents to lodge a principal place of residence exemption request by 31 March 2025 for the preceding land tax year.

Please contact your principal adviser at Prosperity if you require further assistance, considering the NSW surcharge land tax implications of particular residential ownership holdings of land in NSW.