Building a retirement nest egg is essential for financial independence in your later years. There are many ways to do this, through growth assets such as property or shares and more defensive assets such as bonds or cash.

How we choose to “hold” these assets can have a significant impact on the long-term value of your savings due to the differing tax applicable in different structures eg in your own name, jointly owned or a separate structure altogether such as superannuation, trust or company.

In this article we focus on Superannuation.

Superannuation should form a key part of any retirement plan due to the preferential tax benefits this type of investment offers over other structures and the flexibility of how you choose to invest within super.

The rules around super are complex and we note some key considerations and opportunities below.

There are more rules and complexities than those noted. This article should not be considered advice and does not consider your personal circumstances. We recommend you get formal advice before making any investment decisions.

Tax benefits

Superannuation is a trust and therefore separate to our personal marginal rates of tax. Earnings are taxed at the concessional rate of 15% in accumulation phase and 0% in pension phase.

In retirement, you are able to have $1.9m in the pension phase, paying no tax on income and gains within the fund and providing a non-assessable income stream.

For a couple, that is up to $3.8m combined in a tax free “wrapper”.

Getting money into superannuation

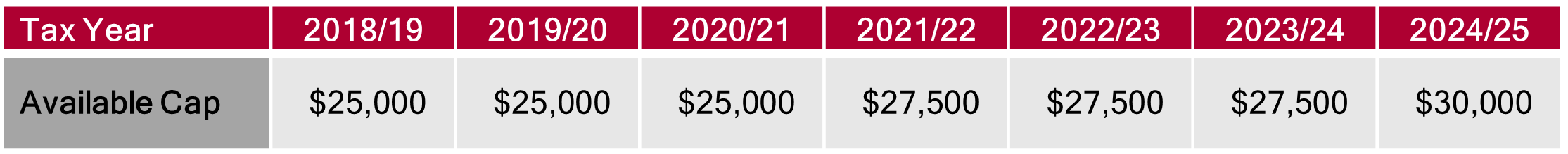

Due to the favourable taxation, the amount that we can contribute to superannuation is restricted by contribution caps (which are periodically indexed).

The most common ways to transfer money into super are concessional contributions (“CCs”), comprised of employer and personal deductible contributions and non-concessional contributions (“NCCs”), contributions made using money we have already paid tax on.

The annual concessional contribution and non-concessional contribution caps are $30,000 and $120,000, respectively.

Total Super Balance

The ability to make NCCs is only available where your Total Super Balance (“TSB”) is under the TSB cap. The TSB is the total of all your super account balances (*) across all policies. This is currently $1,900,000. Additionally, if your balance is close to this cap (in excess of $1,660,000), this can limit your ability to use the bring-forward NCCs.

* A separate calculation is used to determine the value of defined-benefit pensions.

Unused concessional contributions

Currently, individuals with a Total Super Balance under $500,000 (as at the previous 30 June) can use previously unused concessional contributions from the last five tax years. This can be a very valuable means to either simply boost your super balance tax effectively or offer the potential to help reduce the tax from a capital gains tax event.

As this catch-up is only available for the preceding five tax years and uses the oldest tax year first, from 1 July 2024, the available amount from 2018/19 has been lost.

Bring forward contribution

Under current rules, you can opt to “bring forward” two future NCC contribution cap allowances. Effectively allowing you to contribute three tax years at once. You are then unable to make further NCCs until those future years have passed. The current maximum forward contribution in 2024/25 is $360,000.

Contributions up to age 75

Individuals aged less than 75 may make superannuation NCCs regardless of working status. This offers valuable additional time to top-up your super and convert this to a non-assessable (tax-free) income stream.

It also offers opportunities such as:

- Maximizing the total balance a couple can have in superannuation.

- Equalising super balances (ie. where one client may be impacted by the TSB, and the other has a lower balance).

- Reducing potential tax payable on superannuation death benefits through a recontribution strategy.

Downsizer contributions

A government initiative aimed at older Australians to assist in the decision to either move to a smaller/more retirement friendly property, or free up capital for income needs.

Essentially this allows individuals over aged 55, selling a property they have held for over 10 years and for a period as a primary residence, the ability to make a one-off contribution of $300,000 ($600,000 if a couple). This payment is separate to the other concessional and non-concessional contributions.

There are very specific steps in order to make a complying contribution and you should seek advice before looking to implement this strategy to ensure success.

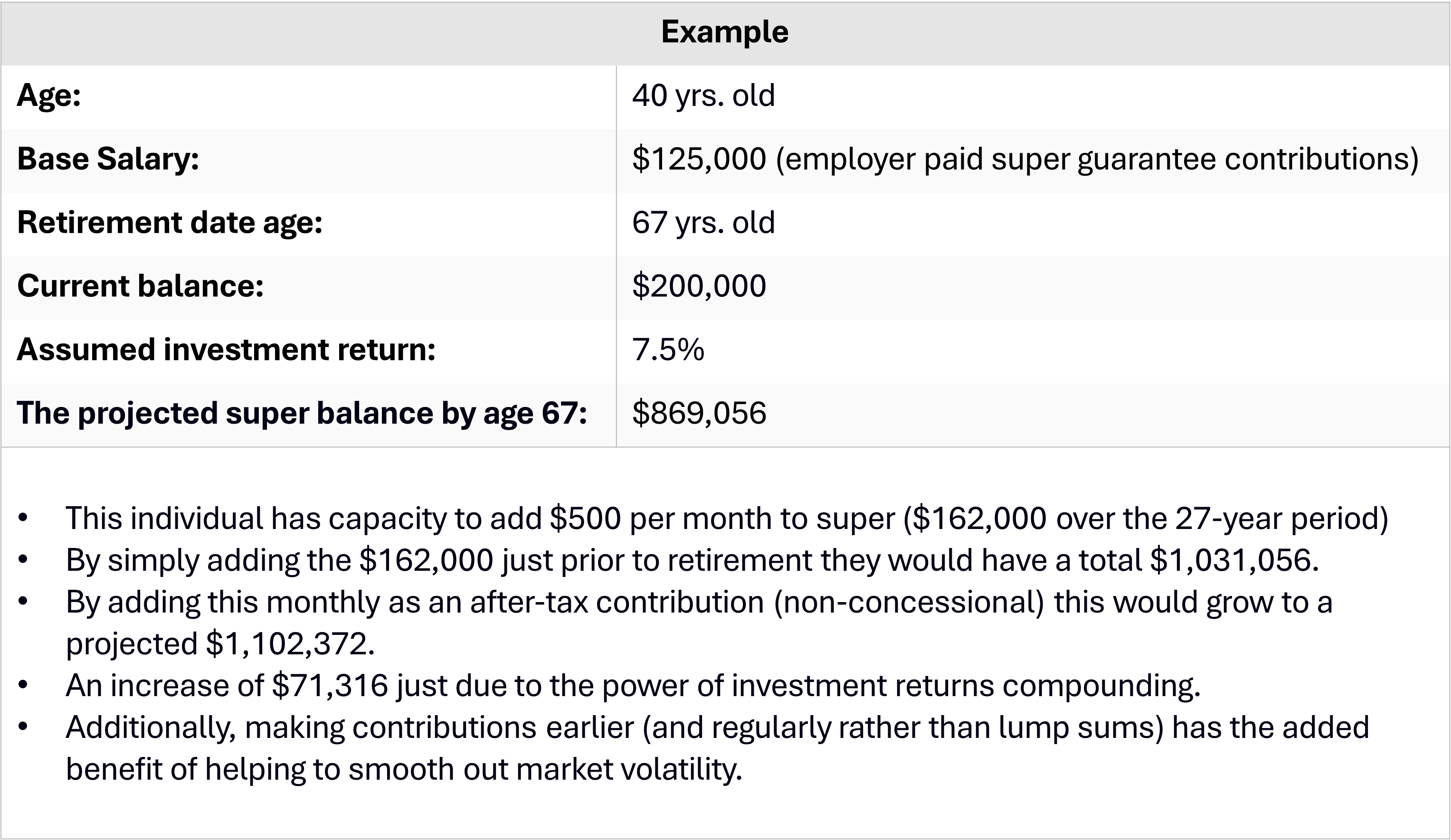

Harnessing the power of compounding returns

As a long-term investment (you cannot generally access your super until you reach 60), we often find clients consider super as something you look at later in life.

However, taking full advantage and reaching the $1.9m lifetime pension limit may be out of reach for a lot of individuals. By starting early you can give your future retirement balance a significant boost using compounding investment returns.

Note: This example is only used to illustrate the positive impact of compounding returns. It may be preferable to make concessional contributions and we strongly recommend you consider your personal circumstances and seek advice prior to making any investments.

For a full breakdown of assumptions, visit the government website. www.moneysmart.gov.au

Other considerations

- The impact of your current contribution strategy if you intend to make future use of a downsizer contribution/or small business tax relief contributions, considering the proposed additional tax on balances over $3,000,000.

- Consider the opportunity for spouse contribution splitting to equalise your balances.

- Consider use of co-contributions or spouse contributions.

- Reviewing your investment option to determine if your current strategy aligns to your long-term goals.

Given the continually changing rules relating to Superannuation and the recent proposal to apply an additional tax to individual balances over $3m, there is no better time to review your superannuation strategy. For more information or to review your superannuation strategy, please contact Prosperity Financial Adviser Graham Southgate at gsouthgate@prosperity.com.au or your principal adviser.